Business

Ensuring Security: Expanding Markets and Trends in Securities Lending, IoT Security, and Security Screening

Market Outlook:

The securities lending market, IoT security market, and security screening market are three key sectors within the broader security market. These markets are driven by increasing concerns about security and the need for advanced solutions to protect assets, data, and individuals.

The securities lending market is a vital part of the financial industry, enabling institutional investors to borrow and lend securities to facilitate short-selling or meet settlement obligations. This market has witnessed steady growth in recent years, primarily fueled by increased demand for short-selling and liquidity management strategies. The market is expected to continue expanding, with emerging economies like China and India experiencing substantial growth in securities lending activities.

The IoT security market is another rapidly growing sector, driven by the proliferation of connected devices and the increasing vulnerability of IoT networks. As more devices get connected to the internet, the risk of cyberattacks and data breaches also rises. This has created a need for robust security solutions to protect IoT ecosystems. The market is expected to grow significantly in the coming years, with the emergence of technologies like blockchain and artificial intelligence contributing to enhanced security measures.

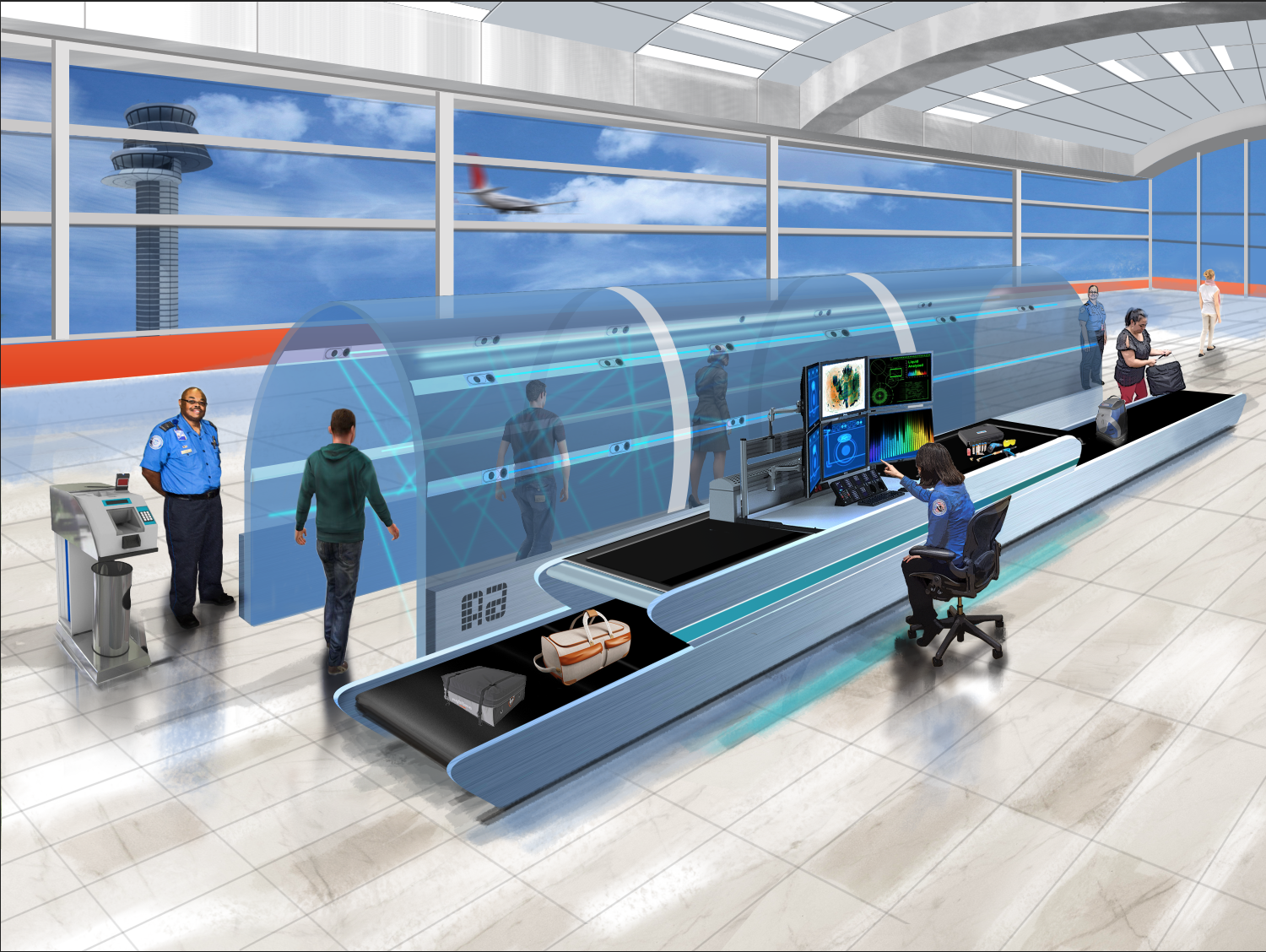

The security screening market is experiencing substantial growth due to various factors, such as the rising threat of terrorism and the increasing need for stringent security measures in public places like airports, train stations, and government buildings. With the introduction of advanced screening technologies like millimeter wave scanners and artificial intelligence-based facial recognition systems, this market is witnessing steady growth and is expected to continue expanding in the future.

Market Trends:

In the securities lending market, one major trend is the increasing participation of non-traditional lenders, such as hedge funds and insurance companies. These players are entering the market to capitalize on opportunities for generating additional revenue. Additionally, the rise of digital platforms is making securities lending more accessible, efficient, and transparent, further driving market growth.

In the IoT security market, the primary trend is the increasing adoption of cloud-based security solutions. As businesses and individuals recognize the challenges of securing their IoT networks, cloud-based solutions provide a scalable and cost-effective approach. Furthermore, the integration of blockchain technology into IoT security is gaining momentum, as it offers enhanced data integrity, transparency, and decentralization.

The security screening market is witnessing a shift towards more advanced screening technologies, moving beyond traditional metal detectors. Advanced screening technologies like X-ray scanners, biometric systems, and explosive detection systems are becoming more prevalent to detect threats more effectively and enhance public safety. Additionally, advancements in data analytics and machine learning are being leveraged to improve screening procedures and reduce false alarms.

Conclusion:

The securities lending market, IoT security market, and security screening market are all experiencing significant growth due to increasing security concerns globally. The securities lending market is driven by demand for short-selling and liquidity management strategies, while the IoT security market is being fueled by the proliferation of connected devices and the need for robust security solutions. The security screening market, on the other hand, is growing due to rising terrorism threats and the adoption of advanced screening technologies. As these markets continue to evolve, various trends like digital platforms, cloud-based solutions, and advanced screening technologies will shape their future.